Indicators on Estate Planning Attorney You Need To Know

Indicators on Estate Planning Attorney You Need To Know

Blog Article

Some Of Estate Planning Attorney

Table of ContentsIndicators on Estate Planning Attorney You Need To KnowEstate Planning Attorney Can Be Fun For AnyoneGetting The Estate Planning Attorney To WorkThe smart Trick of Estate Planning Attorney That Nobody is Discussing

Your lawyer will also help you make your papers official, scheduling witnesses and notary public signatures as needed, so you do not have to bother with trying to do that last step on your own - Estate Planning Attorney. Last, however not the very least, there is valuable tranquility of mind in developing a connection with an estate planning attorney that can be there for you later onPut simply, estate planning attorneys provide value in lots of methods, far past just providing you with published wills, depends on, or other estate planning records. If you have concerns concerning the process and desire to find out extra, call our office today.

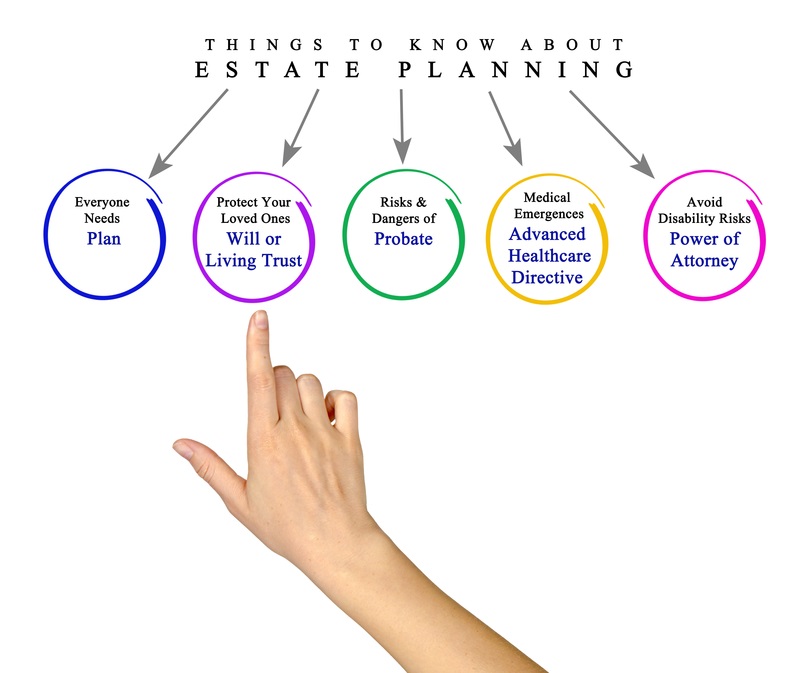

An estate planning attorney helps you define end-of-life decisions and legal files. They can establish up wills, establish trusts, create wellness care regulations, develop power of lawyer, produce sequence plans, and much more, according to your dreams. Working with an estate planning attorney to complete and oversee this lawful paperwork can assist you in the complying with 8 areas: Estate intending lawyers are experts in your state's count on, probate, and tax regulations.

If you do not have a will, the state can choose how to separate your assets amongst your beneficiaries, which could not be according to your wishes. An estate planning attorney can assist organize all your legal records and distribute your assets as you want, potentially preventing probate.

About Estate Planning Attorney

When a customer dies, an estate strategy would certainly determine the dispersal of possessions per the deceased's directions. Estate Planning Attorney. Without an estate strategy, these decisions may be left to the near relative or the state. Responsibilities of estate organizers consist of: Developing a last will and testimony Establishing up trust accounts Calling an administrator and power of attorneys Determining all beneficiaries Calling a guardian for small youngsters Paying all financial obligations and lessening all tax obligations and legal costs Crafting instructions for passing your worths Establishing preferences for funeral arrangements Completing guidelines for treatment if you end up being ill and are unable to choose Obtaining life insurance policy, special needs revenue insurance, and long-term care insurance policy A good estate strategy need to be updated on a regular basis as clients' financial situations, personal motivations, and government and state laws all advance

As with any profession, there are attributes and abilities that can assist you achieve these objectives as you collaborate with your customers in an estate coordinator duty. An estate planning career can be best for you if you have the adhering to qualities: Being an estate planner implies assuming in the long term.

Examine This Report about Estate Planning Attorney

You should assist your Read Full Report customer anticipate his or her end of life and what will certainly happen postmortem, while at the exact same time not dwelling on dark thoughts or feelings. Some customers might end up being bitter or distraught when considering fatality and it could be up to you to assist them with it.

In the event of fatality, you might be expected to have countless conversations and ventures with enduring relative concerning the estate strategy. In order to stand out as an estate coordinator, you might require to walk a fine line of being a shoulder to lean on and the individual counted on to communicate estate preparation issues in a timely and professional manner.

tax code changed countless times in the 10 years in between 2001 and 2012. Expect that it has actually been altered additionally because after that. Depending upon your customer's financial revenue bracket, which may advance toward end-of-life, you as an estate organizer will have to maintain your client's possessions completely legal conformity with any regional, government, or international tax obligation laws.

Some Known Questions About Estate Planning Attorney.

Gaining this certification wikipedia reference from organizations like the National Institute of Certified Estate Planners, Inc. can be a strong differentiator. Being a participant of these professional teams can verify your abilities, making you much more eye-catching in the eyes of a possible customer. In addition to the emotional incentive of assisting customers with end-of-life planning, estate planners delight in the benefits of a secure revenue.

Estate planning is a smart point to do despite your current health and economic condition. However, not many individuals understand where to begin the process. The first vital thing is to hire an estate planning attorney to aid you with it. The complying with are five advantages of dealing with an estate preparation lawyer.

The percentage of individuals who do not know exactly how to get a will has actually raised from 4% to 7.6% considering that 2017. A skilled lawyer knows what details to include in the will, including your recipients and unique considerations. A will certainly protects your household from loss due to immaturity or disqualification. It additionally offers the swiftest and most effective method to transfer your possessions to your beneficiaries.

Report this page